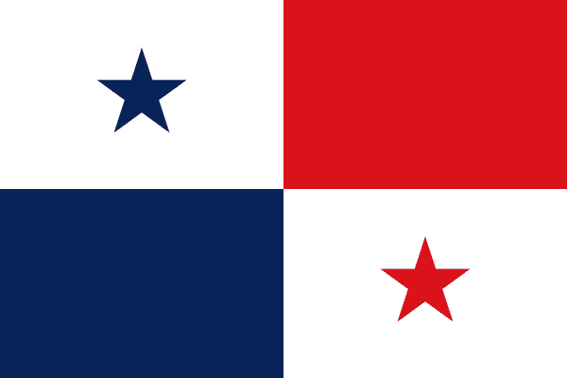

Hire in Panama

Begin your journey into human resources best practices and hiring in Panama here.

The Currency of Panama

Panamanian Balboa (PAB)

The Capital of Panama

Panama City

Time Zone in Panama

EST

Important Facts About the Country of Panama

Introduction to Panama

Panama, officially known as the Republic of Panama, serves as a slender land bridge, or isthmus, linking North and South America. The country’s economy predominantly revolves around services, which contribute to nearly 80% of its GDP. Key sectors within these services include the Panama Canal, banking, commerce, the Colón Free Trade Zone, flagship registry, container ports, and tourism.

What to Know about Panama’s Geography

Panama shares its borders with Costa Rica and Colombia, while the Caribbean Sea lies to its north and the Pacific Ocean to its south. The country boasts an elongated S shape, featuring a Caribbean coastline spanning approximately 1,290 km and a Pacific coast stretching about 1,700 km. In total, Panama covers an area of 75,517 square kilometers.

Climate in Panama

Panama experiences a hot and humid tropical climate, characterized by a lengthy rainy season spanning from May to January and a brief dry season from January to May. The rainy period typically occurs between May and December. Climatic variations are notably distinct between the Atlantic and Pacific sides of western Panama, particularly in terms of the quantity and seasonal distribution of rainfall.

Panama Human Resources at a Glance

Employment Law Protections in Panama

The primary source of employment law in Panama is the Labor Code of 1971, which regulates various aspects of employment such as working hours, holidays, rest periods, wages, overtime, and employment relationships.

Additionally, the Constitution of Panama plays a significant role in safeguarding the fundamental rights of both employers and employees.

Employment Contracts in Panama

Every employee is obligated to sign a written employment contract in Spanish, which must be officially sealed by the Ministry of Labor. Employment contracts are typically presumed to be indefinite, except in cases of temporary positions intended to substitute for workers on vacation, sick leave, or for roles with a specific and limited duration.

Key details that must be included in an employment contract are as follows:

- – Personal details of the employee

- – Names of the employee’s dependents

- – Job description and responsibilities

- – Workplace location

- – Hours of work

- – Date of contract signing

- – Compensation

The Culture of Panama

The majority of Panamanians trace their ancestry to indigenous or native populations, Europeans, Afro-Caribbeans, and immigrants from various regions worldwide. Among the indigenous groups, the largest are the Kunas, Emberás, and Ngöbe-Buglés, who reside in remote areas of the country. These communities maintain their distinct dialects, languages, and traditions, while also commonly speaking Spanish.

Religions Observed in Panama

More than 90% of Panamanians identify as Christians, with Roman Catholicism being the largest denomination, comprising around 80% of the population. The Constitution guarantees freedom of religion, allowing for the practice of minority religions such as Judaism, Buddhism, and the Baháʼí Faith, which collectively make up about 8% of the population.

Languages Spoken in Panama

Spanish serves as the official language of Panama and is spoken by the vast majority of its inhabitants. The country’s seven indigenous groups communicate in a variety of dialects, with Kuna and Ngobe-Bugle being the most prevalent among them.

Panama's Contract Terms

A company with 10 or more employees is required to establish internal work regulations, subject to approval by the Ministry of Labor. Employees possess the right to provide feedback on these regulations, which should be submitted within 30 days of notification.

The internal work regulations must cover various aspects including work schedules, wages, safety and hygiene protocols, obligations of both employer and employee, disciplinary procedures, and provisions addressing discrimination and sexual harassment. Additionally, these regulations should encompass any specific details pertinent to the workplace.

Written in Spanish, the work regulations must be prominently displayed in an accessible location such as the company’s intranet or notice board, ensuring unrestricted employee access.

Fixed Term Contacts for Panama Employees

Fixed-term contracts are limited to temporary positions and must not surpass a duration of one year, except for roles necessitating specialized technical skills, which may extend up to three years.

Extensions of fixed-term contracts are permissible, but upon surpassing the extension period, the contract automatically converts to an indefinite-term contract.

Pre-Employment Checks

Employee approval is necessary for any pre-employment assessments. The employer reserves the right to require a medical examination before or during employment to ascertain the employee’s fitness for work and ensure the safety of coworkers and company assets. With the employee’s consent, the employer may also request a criminal background check. However, a pregnancy test is not permissible.

Panama's Guidelines Regarding Probation Period/Trial Period

The probationary period typically spans up to three months and is applicable to roles demanding specific skills or abilities, excluding entry-level positions.

Throughout this probationary period, the employer retains the right to terminate the contract without cause and without providing severance pay.

Regulations and Rules Regarding Working Hours in Panama

The maximum daily working hours are capped at eight hours, with a weekly limit set at 48 hours.

Employees are entitled to a minimum rest break of 30 minutes to two hours during the workday.

Daytime hours are defined as 6 a.m. to 6 p.m., while night-time hours span from 6 p.m. to 6 a.m. Working more than three hours during the night-time hours constitutes a night shift, with a maximum of seven hours permitted per week.

Rest days are ideally scheduled on Sundays, although a compensatory rest of 24 hours may be provided in exchange.

Panama Laws Regarding Overtime

Overtime compensation is structured as follows:

- – A 25% wage increase for work conducted during the daytime.

- – A 50% wage increase for work performed during the night or for extended mixed shifts that began during the daytime.

- – A 75% wage increase for work that extends a night shift or mixed shift initiated during the nighttime period.

- – On National Holidays (dia de fiesta o duelo nacional), compensation includes a 150% wage increase plus compensatory rest.

Employees are limited to a maximum of three hours of overtime per shift or nine hours per week.

Panama Timesheets & Record Keeping

Employers are required to keep comprehensive records of their employees, encompassing details such as names, addresses, hours worked, overtime hours, and vacation periods. While the Labor Code stipulates that proof of wage payment won’t be demanded by authorities from an employer beyond a five-year period, the Social Security Law imposes a 20-year statute of limitation for legal actions to retrieve any outstanding social security contributions. Consequently, it is advisable for employers to maintain records relating to employees’ payroll, taxes, and social security for a minimum of 20 years.

Rules Regarding Bonus and 13th Month Pay in Panama

Employees have the right to receive a thirteen-month bonus equivalent to one month’s salary, disbursed in three equal installments throughout April, August, and December.

In addition to this obligatory thirteen-month bonus, it is customary for employers to provide performance bonuses in accordance with their respective policies.

Termination

After two years of employment, an employee can only be dismissed for valid reasons, ensuring the employee’s right to job stability. Notification of dismissal, specifying the date and cause, must be provided to the employee. This notification should occur within two months of discovering the cause for dismissal.

Pregnant employees and union members are safeguarded against unjustified dismissal, requiring authorization from the Labor Courts for any termination.

The termination of employment can transpire in four manners:

1. Employee voluntarily resigns

2. Expiration of Fixed-Term Contract (FTC)

3. Mutual agreement between employer and employee

4. Termination by employer

Employees with over two years of tenure can only be dismissed for valid reasons, as stipulated in Panama’s Labor Code. These reasons include:

- Incapacity to work due to physical or mental conditions

- Unexcused absence from work, including two Mondays in a month, six within a year, or any three days in one month

- Economic circumstances adversely affecting the employer’s business

- Employee misconduct or criminal acts

The termination notice must delineate the grounds for termination. In cases of economic grounds, the employer must provide evidence and obtain approval from the Ministry of Labor. Should there be no response from the Ministry within 60 days of submission, the employer can proceed with termination while fulfilling the requisite severance payments.

Panama's Requirements Regarding Notice Periods

Employees with less than two years of service must receive a minimum 30-day notice before termination. Failure to provide notice necessitates payment of ordinary wages equivalent to the notice period.

In the event of resignation, employees must give the employer at least 15 days’ notice, except for technical employees who are required to give a minimum of two months’ notice.

No notice is necessary under the following circumstances:

- The employee is under a fixed-term contract.

- The employee has served for over two years.

Redundancy/Severance Pay in Panama

Severance pay is granted in cases of termination without just cause or premature conclusion of a fixed-term contract. Typically, it amounts to 3.4 weeks of salary per year of service, prorated accordingly.

Employees are entitled to a seniority premium, equivalent to one week of salary per year of service, irrespective of the termination reason.

Severance pay, including the accrued 13th salary and vacation pay, must be disbursed promptly upon termination.

Employees with less than two years of service receive an advance notice payment equal to one month’s salary. Those employed for over two years receive an additional indemnity equal to 6.54% of all wages earned during their tenure, without eligibility for an advance notice payment.

Post-Termination Restraints/Restrictive Covenants

As per the Labor Code, employers are solely authorized to impose limitations on employees’ activities throughout the duration of their employment.

Any restrictions extending beyond employment tenure necessitate mutual agreement between employer and employee before concluding the employment relationship. While compensation can be considered for such limitations, it’s typically uncommon in Panama to implement post-employment restrictions.

Tax and Social Security Information for Employers in Panama

Monthly reporting of social security and income is mandatory, with a unique invoice generated from the Sistema de Ingresos y Prestaciones Económicas (SIPE) upon payment of both taxes and social security. Payment deadlines are set for 30 days from the end of the preceding calendar month.

Personal Income Tax in Panama

| Monthly Band | Tax Rate % |

|---|---|

| Up to USD 11,000 | 0 |

| USD 11,000 – 50,000 | 15.0 |

| Over USD 50,000 | 25.0 |

Social Security in Panama

Social security taxes are deducted from both employers and employees upon salary disbursement. Presently, employers contribute 12.25%, while employees contribute 9.75%.

Furthermore, an extra 1.25% of an employee’s wages is withheld as an “educational tax,” whereas employers bear a 1.5% contribution toward this tax.

| Type | Employer Contribution Rate (%) | Employee Contribution Rate (%) |

|---|---|---|

| Social Security | 12.25 | 9.75 |

| Educational Tax | 1.5 | 1.25 |

| Professional Risk | 0.98 | 0.98 |

The rates provided above serve as general guidance. However, actual charges may vary.

Important Information for Panama Employees

Salary Payment

Employees must receive wages at minimum twice a month, with payment frequency determined by time units such as fortnights, weeks, days, or hours, or by the duration of the specific job.

Monthly-salary employees’ salaries incorporate payment for weekly rest. For those compensated daily or hourly, payment for weekly rest is provided in addition to regular wages.

Annual Leave

After completing 11 months of continuous service, an employee is entitled to 30 days of paid annual leave, equating to one day off for every 11 days worked. Annual leave should be taken either all at once or in two separate blocks, subject to mutual agreement between the employer and employee.

Conversion of annual leave into cash payment is prohibited.

Upon the employee’s request, annual leave can be accrued for up to two years, provided that the initial 15 days have been utilized and notification is given to the labor authority.

Employees must receive payment three days before the commencement of their annual leave.

Sick Leave

Employees are granted 18 days of paid sick leave.

Upon commencement of the employment contract, the employee starts accruing a sick leave fund, amounting to 12 hours for every 26 shifts worked or 104 hours annually. This fund can be utilized fully or partially while maintaining full pay in the event of sickness or accident. Accumulation of the sick leave fund is permissible for up to two years, extending until the third year of service.

Employees on sick leave or absent from work due to work-related accidents or illnesses are protected from termination.

Maternity & Parental Leave

Maternity Leave:

The total duration of maternity leave is 14 weeks, with six weeks to be taken before the estimated date of birth and eight weeks to be taken after childbirth. During pregnancy and maternity leave, it is forbidden for the employer to alter the terms of the employment relationship. Dismissal without cause is prohibited during pregnancy and within the first year of returning to work from maternity leave.

Breastfeeding Break:

Female employees are entitled to a paid 15-minute break every three hours, or, with the agreement of the employee, a 30-minute break twice a day, for breastfeeding purposes. This time allocated for breastfeeding is considered as part of the working hours.

Paternity Leave:

To qualify for three business days of paid paternity leave, an employee must provide the employer with at least one week’s notice of their spouse/partner’s expected delivery date and submit a government-issued birth certificate certifying paternity. Paternity leave must be taken immediately after childbirth.

Adoption Leave:

Female employees are entitled to four weeks of adoption leave from the date of assignment to pre-adoptive foster care. Male employees adopting a child can take two weeks of leave from their annual leave. Payment for adoption leave is covered by the social security fund.

Public Holidays

Typically, Panama observes 13 public holidays throughout the year.

Benefits to the Employee in Panama

Panama’s Social Security System provides the following benefits:

1. Dental, medical, and hospital coverage

2. Disability benefits

3. Maternity leave

4. Worker’s compensation

5. Retirement pensions

6. Death benefits

The severance fund (Fondo de Cesantía) in Panama is mandated by law to ensure that employers provide a seniority premium and compensation to employees with indefinite contracts. In case of unjustified dismissal, workers are entitled to receive compensation from the unemployment fund as guaranteed by law.

Rules Regarding Visas and Foreign Workers in Panama

General Information

Foreign individuals seeking employment in Panama must first obtain an immigration visa and residency status from the National Immigration Service before applying for a work permit. It is the responsibility of the employer to procure the work permit from the Ministry of Labor on behalf of foreign employees. Typically, work permits are valid for two years and can be renewed for an additional two years, though citizens of certain countries may be eligible for three-year permits. Employees under the Marrakech Treaty may renew resident permits and work permits for a maximum of six years.

Companies holding a multinational headquarters license issued by the Ministry of Commerce may exempt foreign employees from obtaining a work permit. Additionally, those with special temporary resident permits may be exempt from income tax and social security contributions.

According to Panamanian law, foreign employment is restricted to 10% of a company’s workforce, with the possibility of an extension to 15% for technical or management-level employees.

Foreign employees in Panama are subject to local employment regulations, and their salaries are subject to income tax and social security contributions at the same rates as Panamanian employees.

Public Holidays Recognized by Panama in 2024

| Occasion | Date | |

|---|---|---|

| 1 | New Year’s Day | January 1 |

| 2 | Martyrs’ Day | January 9 |

| 3 | Carnival | February 13 |

| 4 | Good Friday | March 29 |

| 5 | Labour Day | May 1 |

| 6 | Separation Day from Colombia | November 3 – 4 |

| 7 | Colón Day | November 5 |

| 8 | Uprising of Los Santos | November 10 – 11 |

| 9 | Independence Day from Spain | November 28 |

| 10 | Mother’s Day | December 8 |

| 11 | Mother’s Day Holiday | December 9 |

| 12 | National Mourning Day | December 20 |

| 13 | Christmas Day | December 25 |

Hire New Talent in Panama

Our global hiring services enable you to onboard personnel in any country without the financial commitment required to establish a local entity.